Looking Good Info About How To Keep Vat Records

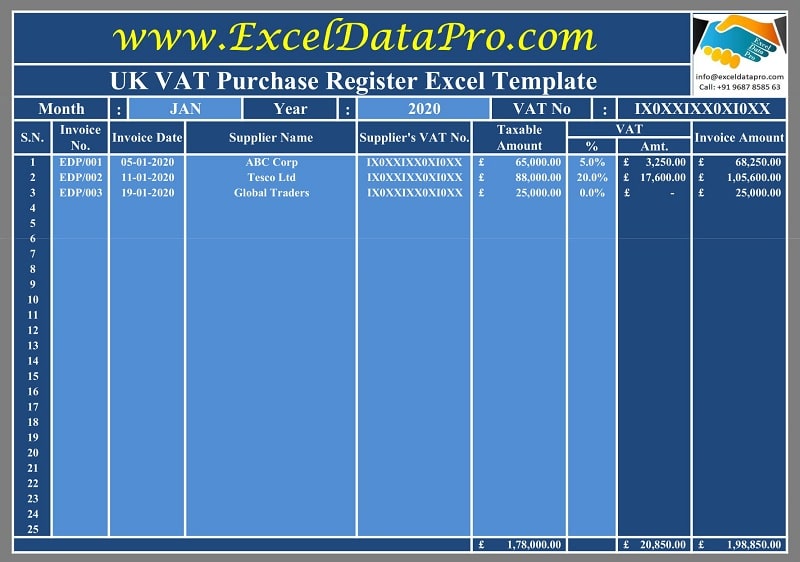

The software you use to submit your return spreadsheets other software or digital products your digital records are used to.

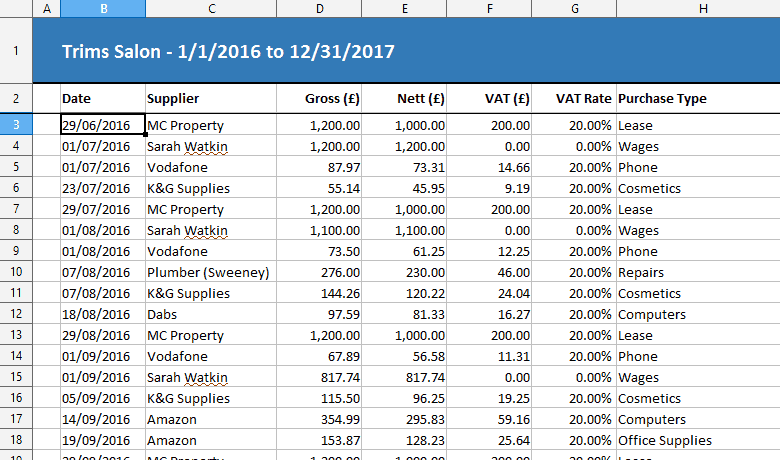

How to keep vat records. You can keep vatrecords on paper, electronically or as part of a. Vat information exchange system (vies) records; Vat registered individual or business must keep the required records for a minimum of 5 years (15 years for real estate owners) after the end of the tax period to which those records relate.

A copy of your vat registration certificate copies of. Records must be available readily in. There is no specific format or way to keep the records, but they must be kept in a way that will allow the fta to easily check the information.

You should keep your vat records. A vat registered individual or company is required. Keep vat records to hand keep a separate folder (electronic or paper) containing:

How to keep vatrecords you must keep vatrecords for at least 6 years (or 10 years if you use the vatmoss service). You’re selling a chair for £60 and need to add 20% vat to get the price including vat. 60 x 1.2 = 72.

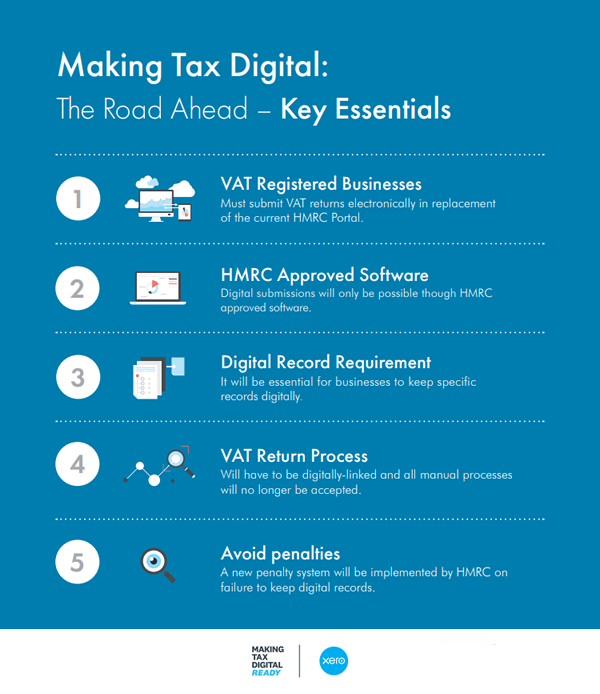

Separate your vat records according to. Old fashioned paper records are still allowed in the united kingdom. In this week’s q&a, david smith, vat adviser at croner taxwise, explains the new digital reporting requirements for all vat registered businesses from april under making tax.

But the records that get kept. To work out a price that includes the reduced rate of vat. Vat records may be kept on paper, electronically or as part of a software program (e.g.

Hmrc state that vat records may be kept on paper, electronically or as part of a software program (eg; You can keep vat records on paper, electronically, or as part of a software program such as bookkeeping soft wares. The price including vat is £72.

You can use any digital product to keep your records, including: Stamped copies of single administrative documents (sads) bank statements. Vat records can be on a computer as individual items or kept as bookkeeping software.

Keep records of sales and purchases keep a separate summary of vat called a. Where the buyer takes on the seller’s vat registration number, the seller must transfer the records to the buyer, unless the seller needs to keep the records.

![Solved Question Five [20] 5.1 Neil Brown Is A Businessman | Chegg.com](https://media.cheggcdn.com/media/5fc/5fcf97ac-ec0b-4e56-b5ae-8d42776fa891/phpMdtu1u)